Family Fleet Insurance

We are currently unable to accept any new business. We are sorry for any inconvenience caused.

If you have any questions please do not hesitate to contact us at: familyfleet@markerstudy.com

We are currently unable to accept any new business. We are sorry for any inconvenience caused.

If you have any questions please do not hesitate to contact us at: familyfleet@markerstudy.com

We pride ourselves on our broker relationships and are happy to combine the flexibility of personal underwriting when required, with the ease and speed of full cycle EDI on the majority of our mainstream products.

Read More

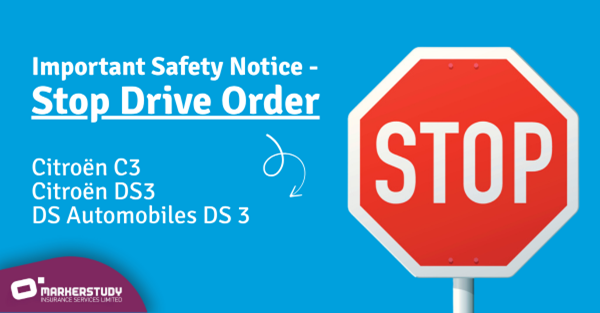

We would like to make you aware of a critical safety issue that may affect your vehicle. Stellantis UK has announced a ‘stop drive’ order that requires urgent attention from affected owners.

Read More